ON THE AGENDA: Twentynine Palms City Council, October 14, 2025

K-B Mart mystery solved, USGS unicorn funded and $122,250 is requested to assess resident tolerance for a sales tax increase

City Council kicks off the month of pumpkin carving, spooks and goblins with a 293-page mid-sized agenda that answers the frequent resident question, “What’s happening at the old K-B Mart?” Spending is also on docket with anticipated approval of funding for the long-awaited US Geological Survey study of regional water supplies and $122,250 requested to sell residents on a sales tax increase.

The agenda for the Tuesday, October 14 meeting can be reviewed in full here. The meeting kicks off with a closed session at 5:30pm, then convenes for open session at 6:00pm.1 Let’s dive in.

1. ANTICIPATED LITIGATION, SIGNIFICANT EXPOSURE TO LITIGATION, Government Code § 54956.9 (d)(2), (1 case)(closed session)

Although the City usually does a poor job of disclosures on closed sessions, we might surmise that this particular gathering out of the public eye pertains to the lawsuit filed against the City and the Ofland Hotel by the Center for Biological Diversity and Indian Cove Neighbors on August 20. That’s because cases based on CEQA have a mandatory settlement conference within 45 days of the service of the lawsuit2 — in this case that deadline likely falls during the week of October 20. Of course, given the title of this item, could there be other lawsuits on the horizon?

PUBLIC COMMENT

You can comment on agenda items and issues important to you at every City Council meeting. Comments on agenda items take place during discussion of that item, while comments on non-agenda items take place near the end of the meeting. The Brown Act prevents Council from commenting on non-agenda items. To comment, just pick up a form at the entry desk, fill it out, and hand it to the Clerk, who usually sits just in front of the Council bench toward the right.

Here’s the list of Council email addresses to write if you can’t get to the meeting — be sure to email them prior to 2 pm on the date of the meeting so they have time to read your email prior to discussion. You can also copy the clerk at cvillescas@29palms.org and ask that your letter be made part of the public record.

AWARDS, PRESENTATIONS, APPOINTMENTS AND PROCLAMATIONS

COUNCIL COMMENTS AND REPORTS OF MEETINGS ATTENDED

After an invocation by Mary Kay Sherry of the Church of Jesus Christ of Latter-day Saints, Council will move to proclaim October as Breast Cancer Awareness month, and report on meetings attended.

CONSENT CALENDAR

The Consent Calendar consists of routine items, usually approved with a single vote. The public is given a chance to make public comment on these items prior to the Council motion. Fill out a comment form specifying the item you wish to address and submit it in person or send an email in advance regarding any of the items on this meeting’s Consent Calendar.

In addition to the usual approval of the warrant register and the second reading of a code change moving the supervision of the City Clerk from Council to the City Manager, the Consent Calendar consists of these tasty nuggets:

4. Approval of Minutes of the City Council Meeting Held on August 26, 2025.

Attendees of the now-infamous August 26 City Council meeting, which consisted of multiple attempts by one Councilmember to undermine a fellow Councilmember, may want to review how the those interactions were captured in the minutes.

6. Annual Development Impact Fee Report for FY 2024-25.

When developers embark on projects they sometimes trigger infrastructure improvements that are outlined in the City’s General Plan and are underwritten through charging the developer a Development Impact Fee. These fees were discussed in an April 2024 article, when their restructuring was reviewed by the Planning Commission.

There are two funds: one for Street Improvements (curb, gutter and sidewalks) and another for Transportation. For the fiscal year ended June 30, 2025, $128,685.25 was collected in Transportation fees, with no expenditures, and $512,749.49 was expended from Street Improvements, primarily for the Safe Routes to School and Cholla Avenue Improvement projects.

7. United States Geological Survey (USGS) Study

This item approves funding for a unicorn that’s been discussed since at least 2022 and some thought had already started months ago — the fabled five-year study of “the geohydrologic and geochemical conditions in aquifers near the City of Twentynine Palms to support water-quality management decisions.”

This is the “cart before the horse item” that was a hot potato during the wastewater treatment plant and sewer wars of 2022 and 2023, with some feeling that this study was needed prior to sewer construction. Due to the government shutdown the October 1, 2025 start date is delayed, but the $2,431,988 needed to proceed appears to finally be allocated.

8. Finding of Convenience and Necessity for 71243 Twentynine Palms Highway. There’s nothing Twentynine Palms loves more than a liquor license. The City has regularly exceeded ABC recommendations for liquor sales in census tracts. This particular tract is already maxed out at three licenses, hence the need for Council ruling on the issuance of a new license for K-B Mart. As argued in the staff report, they did indeed originally have a license, but since then Grocery Outlet opened, adding to Stater Brothers and Dollar General as purveyors of spirits. So the City is likely weighing having the K-B Mart building in use, a plus in a corridor already littered with closed and derelict structures, against adding yet another seller of liquor to the list of retail offerings along 62.

DISCUSSION AND POTENTIAL ACTION ITEMS

10. Preserving City Services and Preliminary Research on a 2026 Tax Measure

This item requests authorization to research residents’ appetites for paying a little extra for gas, food and other necessities to fund City salaries, services and needed improvements, such as a new animal shelter, and then sell them on voting for a sales tax increase on the November 2026 ballot.

Per the staff report:

Despite significant efforts to improve economic conditions within the City of Twentynine Palms, City revenues have remained flat and are projected to either remain flat or slightly decline. Flat or declining revenues are not unique to Twentynine Palms but are rather symptomatic [sic] throughout the State. Despite consistent efforts to “tighten the belt”, operating expenses continue to increase.

The staff report doesn’t indicate what the declining revenues are symptomatic of.

In recent years Council has discussed the possibility of raising the Transient Occupancy Tax (TOT) and/or sales taxes to finance needed improvements several times. However, the staff report on this item recommends a 1% increase in sales taxes and doesn’t mention an attendant increase in TOT taxes.

Currently sales tax in Twentynine Palms is 7.75% and TOT is 10.5%, with 1.5% of TOT dedicated to funding the Tourism Business Improvement District (TBID). For comparison, current sales tax in Yucca Valley is 8.75% and current TOT is 12% Unincorporated San Bernardino County sales tax is 7.75% and TOT is 7% — those rates apply in Joshua Tree for instance.

The proposal before Council is for $122,250, broken down as follows: $22,500 to Probolsky Research to conduct another “survey” on the viability of measure to increase sales tax, $74,750 to Lew Edwards Group to sell it to residents and an additional “communications budget” of $25,000 for “graphic design, printing, bulk postage, digital advertising, or USPS processing fees.” Estimated costs for crafting the ballot measure language and placing it on the ballot are not included in the staff report.

Lew Edwards Group, the same political consulting firm proposed for 29, helped Yucca enact a 1% increase in sales tax in November 2024 and managed the campaign that led Yucca Valley residents to increase their TOT from 7% to 12% via Measure K in November 2022. A measure to increase TOT in unincorporated San Bernardino County from 7% to 11% was defeated by voters in 2024 — that campaign was managed internally by the County.

It should be noted that sales tax is considered a regressive tax, especially in a disadvantaged community like 29. People who earn less, such as those who support the tourism industry, pay a larger share of their salary in sales tax when compared to those with higher earnings. Therefore a 1% sales tax increase as suggested in the staff report, most heavily impacts the poor, whereas an increase in TOT, while generating less revenue, is paid by hotel and motel guests, not by residents.

One might wonder, why isn’t an increase in TOT also being considered as was discussed at strategic planning? That question isn’t addressed in the staff report.

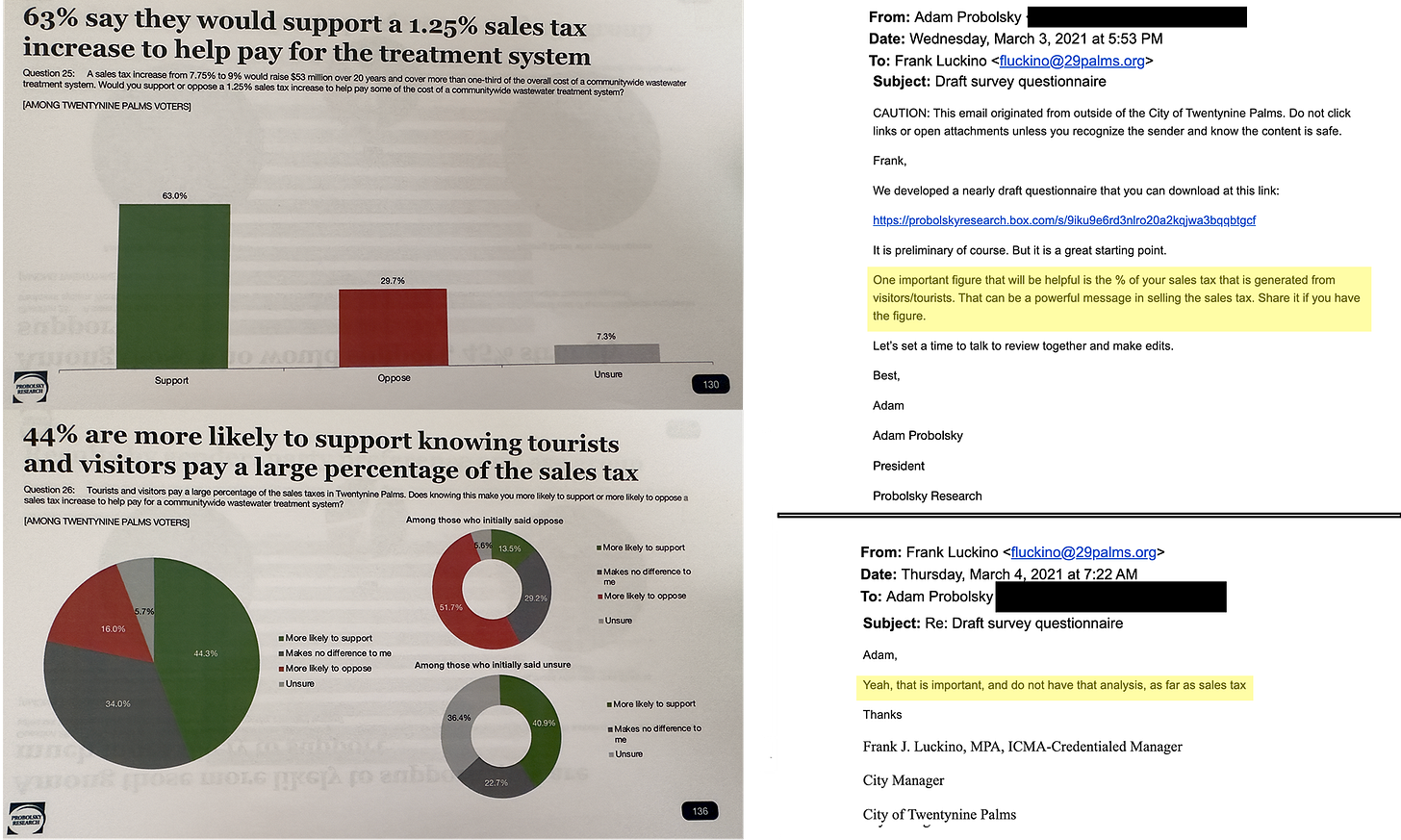

In October 2023 Probolsky Research conducted a survey that appeared to float the concept of a sales tax increase to fund renovation of the animal shelter among other needs. This followed a 2021 survey that queried residents about a 1.25% increase to fund sewer construction. A third survey “to gauge community needs” using a different firm was recommended by City Manager James at the January 25, 2025, Council meeting.

These surveys are generally based on small sample sizes of approximately 300 residents and have featured questions geared toward producing the answers desired by the City utilizing industry practices known as question order bias, response bias and social desirability bias. An example is this question from the 2021 survey: “The City of Twentynine Palms should invest in infrastructure improvements that benefit all residents” (emphasis added). Since a “no” response would support unequal treatment of residents, 270 of 300 respondents answered “yes.” Refer to our October 2023 article on the 2021 survey for an our in-depth analysis of those results.

NOTE: Desert Trumpet staff members Cindy Bernard, Kat Talley-Jones, and Heidi Heard live in the Indian Cove neighborhood, adjacent to this proposed development project, and are on the organizing committees of Indian Cove Neighbors and Say No to Ofland. Read our policy for covering Ofland here.

Leave your thoughts in the comments below. Please note that we do not allow anonymous comments. Please be sure your first and last name is on your profile prior to commenting. Anonymous comments will be deleted.

Feel free to share this article!

We are $105 away from $7000 in paid subscriptions! Who’s going to take us over $7,000? Upgrade to a paid subscription for just $5 per month or $50 per year.

Would you care to donate more than $100? Our Paypal account is up and running!

Clarification of closed and open session times added October 12.

Kracove, Gideon, Tips to Streamline Settlement of CEQA Lawsuits, The Daily Journal, May 23, 2023.